Disclosure: I am long AFL, CVX, GPC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is part 1 of a four-part series about why I chose the 25 stocks listed here. The information contained in the brief summaries was originally published in the article tagged above.

A Brief Summary Of My Strategy

This portfolio will be maintained for about 45 years, into my retirement, and maybe even further into it. I plan to invest an initial amount of $30,000 into some dividend stocks, and add $400 monthly over 45 years, growing the money by 8.3% yearly. (I think this should be achievable as a 10-year backtest showed a return of 10.7% yearly. I know past performance is not a representation of future performance, but I think 8.3% is a fair estimate).

Portfolio Management

To manage my portfolio, I plan to check the news for the stocks in my portfolio every weekend, and read articles on great sites like Seeking Alpha, Yahoo Finance, MSN Money and The Motley Fool. Besides this, when stocks are more overvalued (most stocks are still fairly priced at the moment), I plan to get loaded up on cash (I will add $400 monthly) and collect my dividends while waiting. I will wait for stocks to be more undervalued (e.g., recession, correction) before buying more stock, and will only sell when the dividend stocks decrease their dividend or announce news that is unfavorable to investors.

Here are some of my selling guidelines:

- Decrease / Elimination Of Dividend

- Uncertainty With Future Dividend Payments

- Losing Market Share Rapidly / Not Competitive Enough / Fundamental Problems

The Mission Of The Portfolio

The mission of this portfolio is to provide myself with steady capital appreciation and a growing stream of dividends to be reinvested into the respective companies. Besides this, I also aim for a portfolio that will yield around 4%, and this dividend, along with the returns in the stock price itself, be able to beat both inflation and the major indexes over the years. Later in life during retirement, I also aim to live solely off these dividends and have a good retirement (along with my family).

Here are some general qualities of the stocks in my portfolio:

- All of these stocks have at least 5 years of consecutive dividend increases (except KRFT, a spinoff from the former Kraft Foods).

- All stocks listed have outperformed the S&P 500 during the latest 2008 recession except Aflac (AFL). (the reason is found in the article I linked to above).

- All have payout ratios of below 90%. The exceptions, AT&T (T), Omega Healthcare (OHI) and Kinder Morgan Pt (KMP) are capital intensive businesses and have safe payout ratios when the formula is tweaked from Dividends Paid / EPS to Dividends Paid/FFO.

Here are some general statistics about my portfolio:

- Outperformed the S&P 500 by 6.88% annually over the past 10 years (My portfolio 10.70% vs S&P 500 3.82%, including dividends)

Note: Subject to survivorship bias - Yield of 4.2%

- P/E of 15

- Beta of 0.67

- 5-Year dividend growth of 12.2%

Here are the 7 stocks I am going to cover in this article:

| Company | Consecutive Dividend Increases (Years) | Dividend Yield (%) | 5-year dividend growth |

| Automatic Data Processing (ADP) | 38 | 3.0 | 14.2 |

| Aflac + | 30 | 2.6 | 17.5 |

| Alliance Resource Partners LP (ARLP) + | 10 | 7.5 | 13.6 |

| Colgate-Palmolive (CL) | 49 | 2.4 | 12.7 |

| Chevron (CVX)+ | 25 | 3.3 | 9.0 |

| General Mills (GIS) | 9 | 3.2 | 11.1 |

| Genuine Parts (GPC) | 56 | 3.1 | 6.3 |

Stocks which are trading at or below fair value have an plus (+) next to them.

1. Automatic Data Processing

Automatic Data Processing provides business outsourcing solutions that every company needs. I especially like this holding as it provides a service that companies need, and is a leader in its industry, with 57,000 employees in over 70 counties, serving millions of people worldwide.

The company has a $27.95B market cap and pays a 3.02% dividend as of 21.12.2012's closing price of $57.58. The company has increased its dividends yearly for the past 38 years without fail-- a great achievement, giving it a Dividend Champion status.

I also like the stock in some other ways, fundamentally. Firstly, it has only $16.3M in debt, a negligible amount compared to its equity, and this number has been dropping steadily over the past 10 years. I like this as it proves that the company is earning enough to not consistently rely on debt to perform its internal operations. I also like its steady EPS growth over the past 10 years, and the fact that it has been buying back shares at a respectable rate over the past 10 years, as shown here.

Although this is the case, it is trading at an overvalued 20.4X trailing 12-month earnings, and I do not recommend buying the company at today's prices. I would like to consider a position when the stock price nears the range of $51-$54, which is a more comfortable range for me.

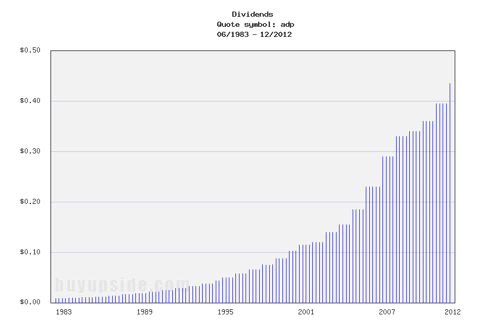

Here is a chart of ADP's dividend payments since 1983, when it first started paying dividends:

(click to enlarge)

2. Aflac

I have written an article about Aflac previously. Aflac provides supplemental health and life insurance in Japan and the USA. I especially like the fact that the company has built a strong brand name in Japan, being the number one Japanese insurance company in terms of individual insurance policies, with every one in four Japanese households holding an Aflac insurance policy.

The company has a $25.23B market cap and pays a dividend of 2.60% as of the 21.12.2012 closing price of $53.81. The company has increased its dividend payments for 30 years straight, giving it Dividend Champion status.

I also like this company in several ways fundamentally. Firstly, it has a low amount of debt, with a debt/equity ratio of only 0.28. The number is acceptable to me, with my personal debt/equity limit at 0.5. This shows that the company is earning enough to not consistently rely on debt to expand itself. The debt/equity ratio, on the other hand, shows the proportion of equity and debt the company is using to finance its assets, and the higher the ratio, the more debt, rather than equity, is financing the company. A high level of debt compared with equity can result in volatile earnings and large interest expenses. Like ADP, it also has a steadily increasing EPS number, with an EPS increase of 10.7% annually since 2002. Its shares outstanding number have also been falling modestly over the past 10 years, as shown here.

I like the company's valuations at the moment. It is trading at 8.9X trailing 12-month earnings, 7.7X forward earnings and 1.8X Free Cash Flow even after performing extremely well Year to date, beating the S&P 500 by more than 15 percentage points. With its 5-year average P/E in the neighborhood of 12X trailing earnings, Aflac still looks like a good buy now.

Here is a chart showing Aflac's dividend payments:

(click to enlarge)

3. Alliance Resource

Alliance Resource Partners, L.P. , a Master Limited Partnership (MLP) engages in the production and marketing of coal primarily to utilities and industrial users. It operates 10 underground mining complexes at the moment, and also leases land and operates a coal loading terminal. As of December 31, 2011, it had approximately 911.4 million tons of proven coal reserves. In addition, the company provides mine products and services. Coal is a relatively unloved sector at the moment, but Alliance has proven its resilience to the decline by dropping much less than competitors, and paying a much higher dividend than its competitors. Alliance has dropped 18.61% year-to-date, while competitor Arch Coal (ACI) has dropped 46.76% year-to date. Competitor Alpha Natural (ANR) has dropped 53.35% year-to-date.

The company has a $2.14B market cap and pays a 7.48% dividend as of 21.12.2012's closing price of $58.06. It has increased its dividend for a streak of 18 consecutive quarters recently, after paying a $1.085 dividend in early November. Besides the quarterly streak, it has increased its dividends for 10 straight years, attaining Dividend Contender status.

I like the company for a couple of reasons fundamentally. Firstly, even after paying dividends to unitholders, its EPS figure still looks impressive, increasing from $1.12 in 2002 to $8.13 in 2011, which represents an 22% increase annually. Secondly, the company's book value per share (BVPS) has increased astronomically over the past 10 years, increasing from $0.55 in 2003 to $18.33 today, representing a 42.1% increase annually over the 10 years. I do not expect this kind of growth in BVPS anymore going forward, but I still expect a rate of increase of around 10%, the average rate for the past 2 years. Thirdly, the company has a high ROE of 24.8%. A high ROE indicates that a company's management is using shareholders' money more effectively, which is good both for the company and its shareholders. The definition of ROE is the amount of net income returned as a percentage of shareholders' investments.

The company is currently trading at a undervalued 9.4X trailing 12-month earnings and at 8.5X forward earnings. This is mainly due to selling pressure for investors who are scared away by coal's prospects at the moment. But, as natural gas prices have increased, almost doubling in price, in fact, companies look like they might be more keen on using coal going forward.

Here is a chart of Alliance's past dividend payments:

(click to enlarge)

4. Colgate-Palmolive

The Colgate-Palmolive Company manufactures and markets consumer products worldwide. It offers oral care products, personal care products, home care products and pet nutrition products which can be found all over the world. All the products (except pet nutrition products) are needed by people all over the world. People need to use toothpaste and a toothbrush regularly, and we frequently need to buy new ones from the nearest supermarket. Therefore, this segment will not go out of business anytime soon. These are the kinds of companies that I am looking to add to my portfolio-- a company that offers something people need.

The company has a $49.66B market cap and pays a 2.36% dividend as of 21.12.2012's closing price of $105.10. Although its dividend is low, it is due to increase its dividend next quarter. Like the previous two companies, this company is a Dividend Champion, with 49 years of consecutive dividend increases.

I also like this company's fundamentals. Firstly, this company seems somewhat recession proof, as shown here. Its EPS numbers have not decreased (and had even increased) much over the past 2 recessions, with EPS decreasing only 5% in the 2002-2003 downturn. During the 2008-2009 recession, its EPS actually increased almost 20%, showing all the more its resiliency to recessions. Secondly, the company has a sky-high 95.25% ROE number. A high ROE indicates that a company's management has put shareholders' investments to good use, which eventually will turn out to be good both for the company and its shareholders. This measures a corporation's profitability by revealing how much profit a company generates with the money shareholders have invested. Thirdly, it has been buying back shares at a respectable rate over the past 10 years, as shown in the link I tagged above.

Although this is the case, it is trading at an overvalued 20.6X trailing 12-month earnings and 19.8X book value, and I do not recommend buying the company at today's prices. I would like to consider a position when the stock price nears the late $90s, early $100s range, which is a more comfortable range for me.

Here is a chart of Colgate-Palmolive's dividend payments:

(click to enlarge)

5. Chevron

Chevron Corporation, through its subsidiaries, engages in petroleum, chemicals, mining, power generation, and energy operations worldwide. It operates in two segments, Upstream and Downstream. Chevron is the second largest oil company in the world, behind Exxon Mobil. The company has a $214.72B market cap and pays a dividend of 3.28% as of the 21.11.2012 closing price of $109.71. The company has increased its dividend payments for 25 years straight, attaining Dividend Champion status just this year.

I also like this company in several ways fundamentally. Firstly, it has a low amount of debt, with a debt/equity ratio of only 0.09. The number is acceptable to me, with my personal debt/equity limit at 0.5. This shows that the company is earning enough to not consistently rely on debt to perform its internal operations. The debt/equity ratio, on the other hand, measures the proportion of equity and debt the company is using to finance its assets and operations. A high level of debt compared with equity can result in volatile earnings and large interest expenses. Secondly, it also has a rapidly increasing EPS number, with an EPS increase of 35.7% annually since 2002. Although this is the case, I do not expect such growth anymore as it is now a mega-cap (>$200B in market cap). Besides this, its shares outstanding number have also been falling modestly over the past 10 years, as shown here.

I like Chevron's valuations at the moment. It is only trading at 9X trailing 12-month earnings at the moment. Although analysts are expecing no growth for the company next year, Chevron still looks like a good buy at these levels.

Here is a chart showing Chevron's dividend payments:

(click to enlarge)

6. General Mills

General Mills manufactures and markets consumer foods worldwide. It offers a variety of ready-to-eat snacks and other such products and a range of organic products. I like this company as people need food to survive, and as less people know how to cook these days, and given the cost of going to a restaurant, more consumers are buying packaged foods like those General Mills is mainly selling. Therefore, companies like General Mills are not going to lose business anytime soon. Although they sound like a boring business, these businesses are usually the ones who are sustainable, and will reward shareholders over the long run.

The company has a $26.52B market cap and pays a 3.21% dividend as of 20.11.2012's price of $41.10. The company has raised its dividends for 9 years straight, and is currently a Dividend Challenger on its way to being a Dividend Contender.

I like this company in several ways. Firstly, I like the fact that employees are extremely happy working in the company at the moment, with a rating of 4.1 (out of 5 stars) at glassdoor.com. The company has also recently been named one of the best companies to work for by glassdoor.com. I feel that employees play a big role in a company's success. They are the ones who actually make all managements' plans possible, and when they are happy, the company is bound to do better. Secondly, its EPS number has been growing modestly over the past 10 years, growing at 6.9% annually since 2002. It is a matured company, so these results are already not bad in my opinion. It has also been buying back shares at a respectable rate over the past 10 years. All this information can be found here.

I think General Mills is slightly overvalued at today's prices. Trading at 16.2X trailing 12-month earnings and at 14.3X forward 12-month earnings, I would be more comfortable buying at or below the $40 mark, which is achievable in the short term in my opinion.

Here is a chart showing General Mills' past dividend payments:

(click to enlarge)

7. Genuine Parts

Genuine Parts Company distributes automotive replacement parts, industrial replacement parts, office products, and electrical/electronic materials in the United States, Puerto Rico, Canada, and Mexico. Genuine Parts is the largest auto parts retailer in the USA, with the largest market cap among its U.S. competitors.

The company has a $9.95B market cap and pays a 3.09% dividend yearly, as of the 21.12.2012 closing price of $64.11. The company has one of the longest dividend-increasing streaks in the world, with 56 years of consecutive dividend increases, undoubtedly gaining Dividend Champion status.

I like the company's fundamentals in a few ways. Firstly, even though it is extremely cyclical, its EPS numbers have been growing relatively steadily over the past 10 years, growing an average of 5.5% annually. Besides this, EPS had only decreased in 7 of the past 10 years, which is really not bad for a cyclical company. Secondly, the company has been buying back shares at a modest rate over the past 10 years, as shown here, with shares outstanding decreasing 1.2% annually over the past 10 year. Further, debt has been kept minimal, with the number at $500.0M at the moment. The number has also been kept at or under this $500.0M level over the past 8 years, which is remarkable in my view. This shows that the company is earning enough to not consistently rely on debt to expand itself.

Trading at 16.1X trailing 12-month earnings and 14.8X forward earnings, the company seems slightly overvalued at today's prices. Fair price should be around the low $60s range, and a price I'm comfortable buying at is in the $60-$62, which is not far from its recent closing price.

Here is a chart showing Genuine Parts' past dividend payments:

(click to enlarge)

Conclusion

In conclusion, to make up my portfolio, I like to choose companies with steady earnings growth, steady dividend growth, and those that have a business that sells a product/offers a service that people need. These companies-- however boring their businesses are-- will reward shareholders over time. Additionally, if you are considering to buy any of the stocks listed here, please also do your own due diligence before buying as I have only covered a few of the companies' qualities briefly.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.